Exploring the realm of accounting software, this article delves into the differences between QuickBooks Self Employed and traditional accounting software, shedding light on their key features, pricing structures, and target users.

As we navigate through the nuances of user interfaces, expense tracking capabilities, and customer support offerings, readers will gain valuable insights into choosing the right accounting solution for their needs.

QuickBooks Self Employed vs Traditional Accounting Software

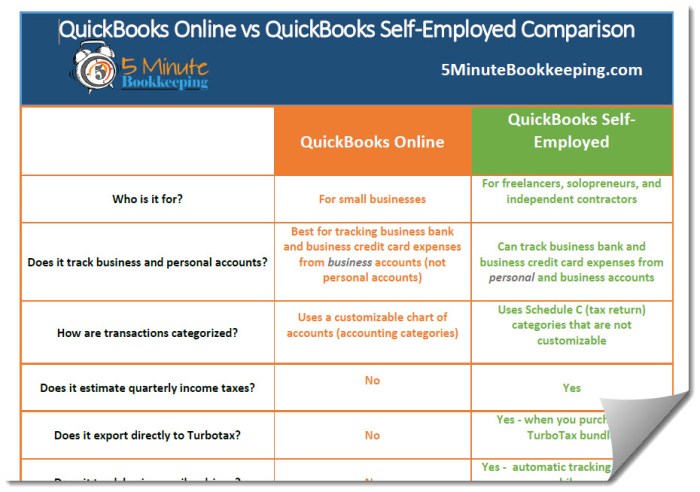

When comparing QuickBooks Self Employed with traditional accounting software, it's essential to understand the key features, pricing structures, and which businesses benefit more from each option.

Key Features

- QuickBooks Self Employed: Offers invoicing, expense tracking, mileage tracking, and tax estimation features tailored for self-employed individuals.

- Traditional Accounting Software: Provides comprehensive features like general ledger, accounts payable/receivable, financial reporting, and inventory management suitable for larger businesses.

Catering to Self-Employed Individuals

- QuickBooks Self Employed: Specifically designed for freelancers, independent contractors, and small business owners to manage their finances easily and efficiently.

- Traditional Accounting Software: More suitable for medium to large businesses with complex accounting needs and multiple users handling financial transactions.

Pricing Structures

- QuickBooks Self Employed: Offers monthly subscription plans starting at a lower cost, making it affordable for individuals with basic accounting needs.

- Traditional Accounting Software: Typically involves higher upfront costs and may require additional fees for user licenses, upgrades, and support services.

Beneficial Industries for QuickBooks Self Employed

- Freelancers: Individuals offering services in creative fields, consulting, or other self-employed professions benefit from the simplicity and ease of QuickBooks Self Employed.

- Independent Contractors: Professionals working on short-term projects or gig-based jobs find QuickBooks Self Employed ideal for managing their finances on the go.

User Interface and Ease of Use

When comparing QuickBooks Self Employed and traditional accounting software, one crucial aspect to consider is the user interface and ease of use. This determines how efficiently users can navigate the software, input data, and generate reports. Let's delve into the specifics of each option.

User Interface of QuickBooks Self Employed

QuickBooks Self Employed is known for its user-friendly interface designed specifically for self-employed individuals and freelancers. The dashboard is intuitive, with clear sections for income, expenses, and tax deductions. Users can easily track their finances and categorize transactions with minimal effort.

The overall layout is streamlined and visually appealing, making it easy to find essential features.

User Interface of Traditional Accounting Software

Traditional accounting software often has a more complex interface compared to QuickBooks Self Employed. The interface may consist of multiple tabs, menus, and submenus, which can be overwhelming for beginners. Navigating through various functions and reports may require some time to familiarize oneself with the software's layout.

Ease of Use for QuickBooks Self Employed

QuickBooks Self Employed offers a straightforward approach to data input and navigation. Users can easily connect their bank accounts, import transactions, and categorize expenses with minimal manual input. Generating tax reports and profit/loss statements is simplified, making it ideal for individuals with limited accounting knowledge.

The learning curve for beginners is relatively low, allowing users to grasp the software quickly.

Ease of Use for Traditional Accounting Software

On the other hand, traditional accounting software may pose a steeper learning curve for beginners due to its intricate interface and extensive features. Users may need to undergo training or seek assistance to effectively utilize all functions and generate comprehensive financial reports.

While traditional software offers robust capabilities, it may require more time and effort to master compared to QuickBooks Self Employed.

Comparison Table: User Interface Differences

| Aspect | QuickBooks Self Employed | Traditional Accounting Software |

|---|---|---|

| Interface | Intuitive and user-friendly | Complex layout with multiple functions |

| Data Input | Automated import and categorization | Manual input required for various transactions |

| Report Generation | Simple and quick tax reports | Comprehensive financial reports with customization |

Tracking Expenses and Income

In managing finances as a self-employed individual, tracking expenses and income is crucial for maintaining financial health and making informed business decisions. Let's explore how QuickBooks Self Employed and traditional accounting software assist in this aspect.

QuickBooks Self Employed

- QuickBooks Self Employed provides a user-friendly platform for tracking expenses and income, allowing self-employed individuals to categorize transactions efficiently.

- The software integrates with bank accounts and credit cards, automatically importing transactions for easy categorization and tracking.

- Users can set rules for recurring transactions, saving time on manual input and ensuring consistent categorization.

- QuickBooks Self Employed also offers features like mileage tracking for those who need to track travel expenses for their business.

Traditional Accounting Software

- Traditional accounting software typically offers more customization options for tracking expenses and income compared to QuickBooks Self Employed.

- Users can create custom expense categories and income streams tailored to their specific business needs.

- These software solutions often provide more detailed reporting capabilities, allowing for in-depth analysis of financial data.

- However, the level of customization may require more time and effort to set up initially compared to the more streamlined approach of QuickBooks Self Employed.

Tips for Maximizing Expense and Income Tracking

- Regularly review and categorize transactions to ensure accurate financial records.

- Take advantage of automation features to streamline the tracking process and minimize manual data entry.

- Utilize reporting tools to gain insights into spending patterns and revenue sources, enabling better financial planning.

- Consider your specific business needs when choosing between QuickBooks Self Employed and traditional accounting software to ensure the software aligns with your tracking requirements.

Customer Support and Training

When it comes to managing your accounting software, having reliable customer support and training resources is crucial. Let's take a look at how QuickBooks Self Employed and traditional accounting software compare in terms of customer support and training options.

Customer Support Services

- QuickBooks Self Employed: QuickBooks offers customer support through phone, chat, and email. Users can easily reach out to the support team for assistance with any issues they may encounter.

- Traditional Accounting Software: Traditional accounting software providers also offer customer support through various channels like phone and email. However, the response time and availability of support may vary depending on the provider.

Training Resources

- QuickBooks Self Employed: QuickBooks provides a range of training resources including tutorials, webinars, and guides to help users navigate the software effectively. Users can also access a knowledge base for self-learning.

- Traditional Accounting Software: Traditional accounting software typically offers training resources such as user manuals and online documentation. Some providers may also offer training sessions or workshops for a more hands-on approach.

Availability of Live Support, Tutorials, and Community Forums

- QuickBooks Self Employed: QuickBooks offers live support, tutorials, and a community forum where users can interact with other users, ask questions, and share knowledge and experiences.

- Traditional Accounting Software: Traditional accounting software providers may offer live support, tutorials, and community forums as well, but the availability and responsiveness of these resources can vary between different providers.

Overall, having access to reliable customer support and training resources is essential for users to make the most out of their accounting software.

Final Review

In conclusion, the comparison between QuickBooks Self Employed and traditional accounting software reveals the strengths and weaknesses of each option, empowering users to make informed decisions based on their specific requirements and preferences.

Quick FAQs

Is QuickBooks Self Employed suitable for small businesses?

QuickBooks Self Employed is tailored for self-employed individuals rather than small businesses. Traditional accounting software may be more suitable for small business needs.

Can traditional accounting software track expenses as effectively as QuickBooks Self Employed?

Traditional accounting software can offer robust expense tracking capabilities, but QuickBooks Self Employed is designed specifically to cater to the needs of self-employed individuals, making it more streamlined for this purpose.

Does QuickBooks Self Employed provide training resources for beginners?

Yes, QuickBooks Self Employed offers various training resources, including tutorials and community forums, to help beginners navigate the platform effectively.

What industries benefit the most from using QuickBooks Self Employed?

Industries with freelancers, independent contractors, or sole proprietors can benefit significantly from QuickBooks Self Employed due to its focus on self-employed individuals.