Delving into the world of electric vehicle stocks to buy, this guide aims to provide valuable insights for potential investors looking to capitalize on the growing market. From key players to technological advancements, this overview covers all the essential aspects that influence stock prices in this dynamic industry.

Overview of Electric Vehicle Stocks

Electric vehicle stocks have been on the rise in recent years, driven by the increasing global demand for sustainable transportation solutions. Investors are paying close attention to this sector due to the potential for growth and innovation. Let's take a closer look at the current market trend for electric vehicle stocks, key players in the industry, and the factors influencing their rise.

Current Market Trend

The electric vehicle market is experiencing significant growth, with more consumers opting for environmentally friendly transportation options. This trend is fueled by government initiatives, such as tax incentives and stricter emissions regulations, pushing automakers to invest in electric vehicles. As a result, electric vehicle stocks have been performing well on the stock market, attracting investors looking for long-term sustainability and profitability.

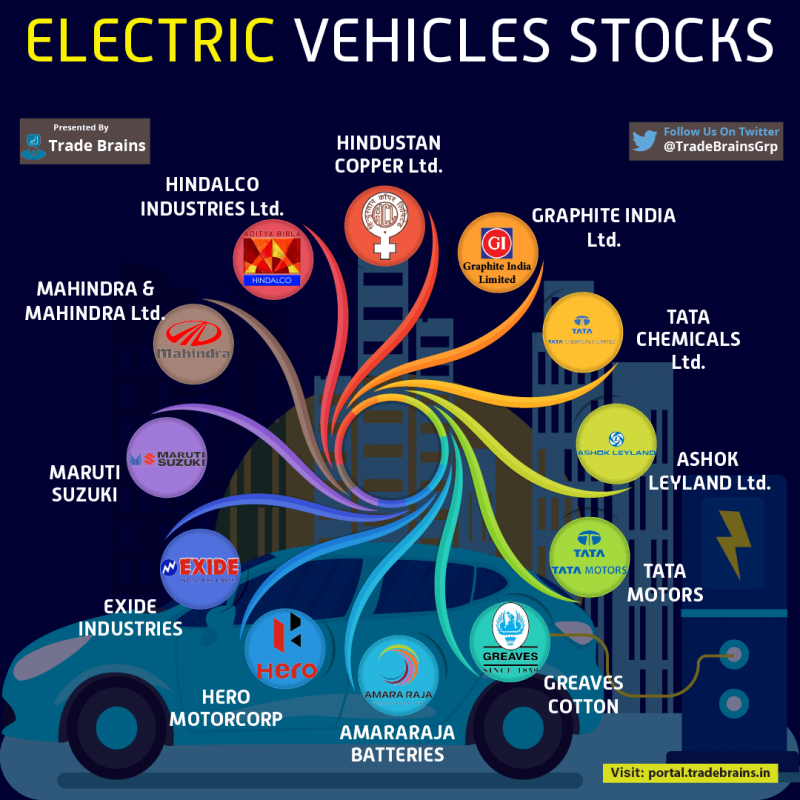

Key Players in the Industry

Some of the key players in the electric vehicle industry include Tesla, NIO, and BYD, among others. Tesla, led by Elon Musk, is a pioneer in the electric vehicle market and has a strong presence worldwide. NIO, a Chinese electric vehicle manufacturer, has been gaining traction with its innovative designs and technology.

BYD, another Chinese company, is known for its electric buses and trucks, making a significant impact in the commercial vehicle sector. These companies represent potential opportunities for stock investment in the electric vehicle industry.

Factors Influencing the Rise in Electric Vehicle Stocks

Several factors contribute to the rise in electric vehicle stocks, including advancements in battery technology, increased charging infrastructure, and growing consumer awareness of climate change. Battery technology plays a crucial role in the development of electric vehicles, with companies investing heavily in research and development to improve efficiency and range.

The expansion of charging infrastructure is also essential for the widespread adoption of electric vehicles, providing convenience and accessibility to consumers. Moreover, the shift towards sustainability and the push for cleaner energy sources have spurred interest in electric vehicles, driving the growth of electric vehicle stocks in the market.

Fundamental Analysis of Electric Vehicle Companies

When evaluating electric vehicle stocks, it is crucial to consider various financial metrics to make informed investment decisions. Factors such as revenue growth, profit margins, and market share play a significant role in determining the performance of electric vehicle companies in the stock market.

Additionally, government policies and incentives can also impact the stock prices of these companies.

Financial Metrics to Consider

- Revenue Growth: Analyzing the revenue growth of electric vehicle companies can provide insights into their market performance and potential for future expansion. Companies with consistent revenue growth are generally seen as more stable and attractive to investors.

- Profit Margins: Examining the profit margins of electric vehicle companies helps in assessing their efficiency in generating profits from their operations. Higher profit margins indicate better profitability and financial health.

- Market Share: Understanding the market share of electric vehicle companies is crucial for evaluating their competitive position within the industry. Companies with a larger market share tend to have more influence and potential for growth.

Comparison of Company Performance

- Tesla: Tesla has shown remarkable revenue growth over the years, solidifying its position as a leader in the electric vehicle market. The company has also maintained strong profit margins, contributing to its overall success.

- Nio: Nio, a Chinese electric vehicle manufacturer, has been gaining market share and expanding its presence globally. The company's revenue growth and profit margins have shown positive trends, attracting investors' attention.

- General Motors: As a traditional automaker transitioning to electric vehicles, General Motors has been focusing on increasing its market share in the EV segment. The company's revenue growth and profit margins in the electric vehicle sector are essential factors to monitor.

Impact of Government Policies

Government policies and incentives can significantly influence the stock prices of electric vehicle companies

. Measures such as tax credits, subsidies, and regulatory requirements can impact consumer demand for electric vehicles, thereby affecting the financial performance of companies in the sector.

Investors should closely monitor government policies related to the electric vehicle industry to anticipate potential market shifts and opportunities.

Technological Advancements in Electric Vehicles

Electric vehicles have seen significant advancements in technology in recent years, leading to improved performance, range, and overall efficiency. These technological innovations play a crucial role in shaping the future of electric vehicles and subsequently impacting stock performance in the market.

Battery Technology Advancements

The advancements in battery technology have been a game-changer for electric vehicles. Companies are continuously working on developing more efficient and cost-effective batteries with higher energy density. These advancements not only increase the driving range of electric vehicles but also reduce charging times, making them more convenient for consumers.

The development of solid-state batteries and other innovative technologies is expected to further revolutionize the electric vehicle industry and potentially boost stock prices of companies leading the charge in battery technology research and development.

R&D Investments of Leading Companies

Leading electric vehicle companies are investing heavily in research and development to stay ahead in the competitive market. Companies like Tesla, NIO, and Rivian are allocating significant resources to innovate and develop cutting-edge technologies for their electric vehicles. These investments not only drive technological advancements but also enhance the overall value proposition of their products, attracting more consumers and investors alike.

The R&D investments of these companies are closely monitored by analysts and investors as they can significantly impact stock valuation and market performance.

Environmental and Social Factors

Electric vehicle stocks are not only influenced by technological advancements and market demand but also by environmental and social factors. The shift towards sustainability and eco-friendly transportation has a significant impact on the performance of electric vehicle companies in the stock market.

Environmental Regulations and Sustainability Efforts

Environmental regulations play a crucial role in shaping the future of electric vehicle stocks. As governments around the world implement stricter emissions standards and promote sustainable practices, companies that focus on electric vehicles are poised to benefit. These regulations can create a favorable environment for electric vehicle stocks to thrive, as they align with the global push towards reducing carbon emissions and combating climate change.

- Companies that prioritize sustainability efforts, such as using renewable energy sources in their manufacturing processes or implementing green initiatives, are likely to attract environmentally-conscious investors.

- Investors are increasingly looking for opportunities to support companies that are committed to reducing their carbon footprint and promoting a cleaner, greener future.

- As consumers become more aware of the environmental impact of their choices, they are more inclined to support companies that align with their values, leading to increased demand for electric vehicles and ultimately driving up stock prices.

Consumer Trends towards Eco-Friendly Transportation

The growing trend towards eco-friendly transportation is a key driver of the demand for electric vehicles and, in turn, affects the performance of electric vehicle stocks in the market.

- Consumers are increasingly opting for electric vehicles as a more sustainable and environmentally-friendly alternative to traditional gasoline-powered cars.

- The rise of electric vehicle sales is indicative of a shift in consumer preferences towards cleaner modes of transportation, reflecting a broader societal move towards sustainability.

- This consumer trend towards eco-friendly transportation is likely to continue to grow as more people become aware of the benefits of electric vehicles and the importance of reducing carbon emissions.

Social Impact of Electric Vehicles

Electric vehicles play a crucial role in reducing carbon emissions and combating climate change, making them a socially responsible choice for consumers and investors alike.

- The adoption of electric vehicles contributes to a significant decrease in greenhouse gas emissions, helping to mitigate the impact of climate change.

- By choosing electric vehicles, consumers are actively participating in efforts to create a cleaner and more sustainable future, which can have a positive impact on their communities and the planet as a whole.

- As the social awareness of environmental issues continues to grow, the demand for electric vehicles is expected to rise, leading to a positive correlation with the performance of electric vehicle stocks in the market.

Closure

Wrapping up our discussion on electric vehicle stocks to buy, it's evident that the landscape is ripe with opportunities for savvy investors. With factors like technological innovations and environmental considerations shaping the market, now is the time to consider adding electric vehicle stocks to your investment portfolio.

FAQ Resource

Are all electric vehicle stocks equally affected by market trends?

No, the performance of individual stocks can vary based on company-specific factors and market conditions.

What role do government policies play in influencing electric vehicle stock prices?

Government policies can significantly impact stock prices by providing incentives or regulations that affect the adoption of electric vehicles.

How do technological advancements in battery technology affect electric vehicle stocks?

Advancements in battery technology can enhance the performance and appeal of electric vehicles, which in turn can positively influence stock prices.