Exploring the evolving landscape of investment platforms and market access, this article delves into the key factors driving change in the industry. From technological advancements to regulatory shifts, the dynamics of accessing investment opportunities are undergoing a significant transformation.

As we navigate through the intricacies of investment platforms and market access, it becomes evident that the traditional paradigms are being challenged by innovation and inclusivity.

Impact of Technology on Investment Platforms

Technology has significantly transformed investment platforms, making them more accessible, efficient, and user-friendly. One of the key aspects of this transformation is the integration of artificial intelligence (AI) and machine learning algorithms, which have revolutionized market access for investors.

Role of Artificial Intelligence and Machine Learning

AI and machine learning play a crucial role in changing market access by providing investors with valuable insights, personalized recommendations, and real-time data analysis. These technologies can analyze vast amounts of data at a speed and scale that surpass human capabilities, allowing for more informed investment decisions.

- AI-powered Robo-advisors: Robo-advisors use algorithms to create and manage investment portfolios based on individual risk profiles and financial goals. They offer automated, low-cost investment solutions that are accessible to a wider range of investors.

- Predictive Analytics: Machine learning models can predict market trends, identify patterns, and suggest potential investment opportunities. This enables investors to make data-driven decisions and optimize their portfolios for better returns.

- Algorithmic Trading: Algorithms are used to execute trades at optimal times based on predefined rules. This eliminates human emotions from the trading process and ensures faster execution, leading to improved efficiency and reduced risk.

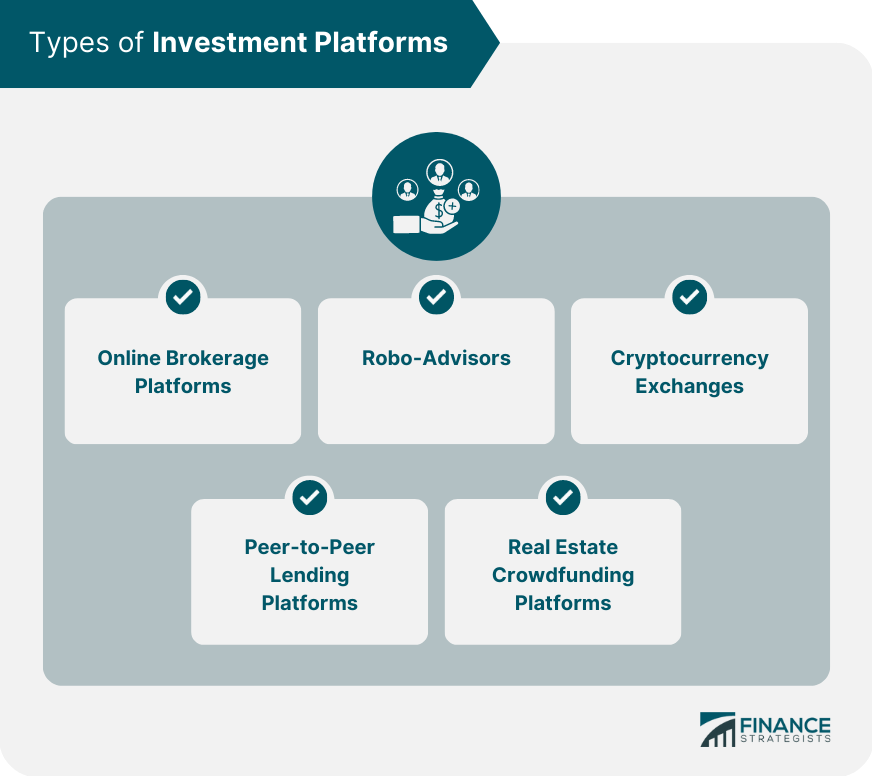

Diversification of Investment Options

Investment platforms are now offering a wide range of investment options to cater to the diverse needs and preferences of investors. Diversification is crucial in spreading risk and maximizing returns, making it essential for platforms to provide various choices for investors.

Importance of Offering a Wide Range of Investment Options

- By offering a diverse set of investment options, platforms allow investors to create a well-balanced portfolio that can withstand market fluctuations.

- Different investment options have varying levels of risk and return potential, providing investors with the opportunity to customize their portfolios based on their risk appetite and financial goals.

- Access to a wide range of investment options also helps in tapping into different market sectors and asset classes, reducing the overall portfolio risk.

Alternative Investments Gaining Popularity

- Alternative investments such as peer-to-peer lending, real estate crowdfunding, and cryptocurrencies are gaining popularity among investors looking for higher returns and portfolio diversification.

- These alternative investments offer unique opportunities that traditional asset classes like stocks and bonds may not provide, adding another layer of diversification to investors' portfolios.

- As alternative investments become more mainstream, they are reshaping the dynamics of the market and influencing the way investors approach portfolio construction.

Comparison of Traditional and Innovative Investment Options

- Traditional investment options like stocks, bonds, and mutual funds have long been staples in investors' portfolios, offering stability and consistent returns over time.

- However, newer innovative options such as robo-advisors, thematic investing, and ESG (Environmental, Social, and Governance) funds are gaining traction for their ability to provide tailored investment solutions and align with investors' values and preferences.

- These innovative options leverage technology and data analytics to offer personalized investment strategies, making them attractive choices for investors seeking a more hands-off approach to investing.

Accessibility and Inclusivity in Market Access

Investment platforms have revolutionized the way people can access financial markets, making it easier for a broader audience to participate in investing. This has been particularly beneficial for individuals who were previously excluded from traditional investment opportunities due to various barriers.

Impact of Fractional Investing

Fractional investing has been a game-changer in increasing market access for individuals with limited capital. This concept allows investors to own a fraction of a high-priced asset, such as a stock or real estate property, without having to purchase the whole unit.

By enabling people to invest with smaller amounts of money, fractional investing has democratized access to a wide range of investment opportunities that were once reserved for wealthy individuals

- Investors can now diversify their portfolios by investing in multiple assets with smaller amounts of capital.

- Fractional investing platforms have lowered the barrier to entry for new investors, especially young individuals or those from underrepresented communities.

- This approach promotes financial inclusion by allowing a more diverse group of people to participate in the financial markets.

Initiatives Promoting Inclusivity and Diversity

Several initiatives have emerged to promote inclusivity and diversity in investment opportunities, aiming to level the playing field for all investors regardless of their background or financial status.

- Impact Investing: Some platforms focus on supporting investments that generate positive social or environmental impact, providing investors with opportunities to align their financial goals with their values.

- Education and Outreach Programs: Many investment platforms offer educational resources and workshops to help individuals, especially those from marginalized communities, understand investing and make informed decisions.

- Diverse Asset Offerings: Platforms that offer a wide range of investment options, including stocks, bonds, cryptocurrencies, and alternative assets, cater to the diverse preferences and risk profiles of investors from different backgrounds.

Regulatory Changes Influencing Market Access

As the investment landscape continues to evolve, regulatory changes play a crucial role in shaping how investment platforms operate and provide access to markets. These changes are designed to ensure investor protection, market integrity, and overall financial stability.

Key Regulatory Changes

- Implementation of GDPR: The General Data Protection Regulation (GDPR) has impacted how investment platforms handle customer data, ensuring transparency and data protection for investors.

- Increased AML/KYC Requirements: Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations have become more stringent, requiring platforms to verify the identity of their users and monitor transactions closely.

- MiFID II Compliance: Markets in Financial Instruments Directive II (MiFID II) has introduced new transparency requirements for financial markets, impacting how investment services are provided and executed.

Compliance Requirements and Market Access

Compliance requirements are essential for maintaining trust in the investment industry and protecting investors from fraudulent activities. While these regulations may impose additional costs and administrative burdens on investment platforms, they also create a more secure and transparent environment for investors to participate in the markets.

Balancing Regulatory Oversight and Innovation

Finding a balance between regulatory oversight and fostering innovation is crucial for the investment industry to thrive. While regulations are necessary to protect investors and maintain market integrity, they should also allow room for innovation and technological advancements that can enhance market access and investment opportunities.

Conclusion

In conclusion, the shift towards more diverse investment options, enhanced accessibility, and regulatory adaptations is reshaping how individuals engage with the market. The evolution of investment platforms reflects a broader trend towards democratizing finance and fostering a more inclusive investment landscape.

Question Bank

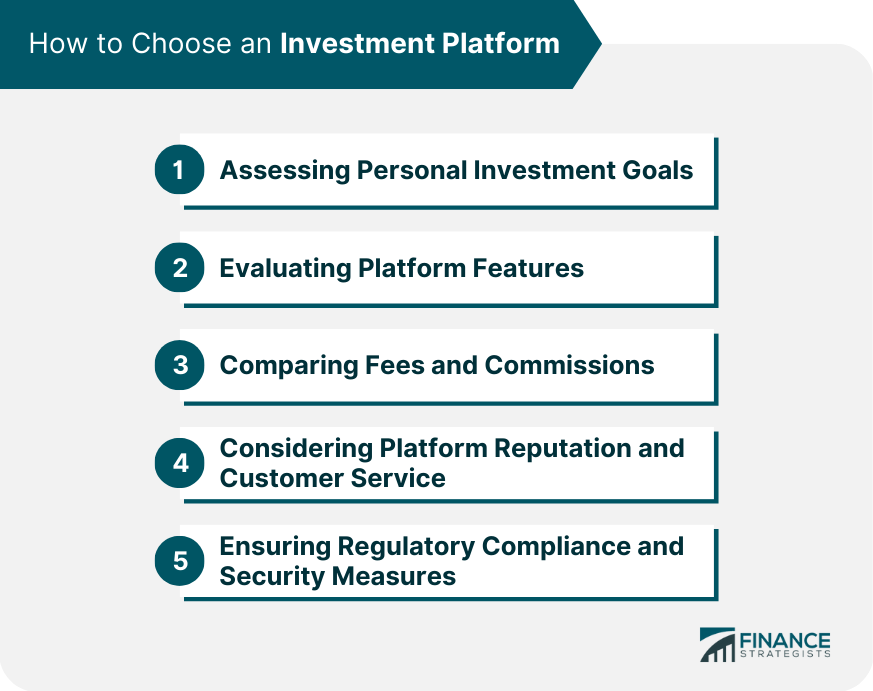

How are investment platforms leveraging technology to change market access?

Investment platforms are utilizing advanced technologies like artificial intelligence and machine learning to enhance user experience, offer personalized investment recommendations, and provide real-time market insights.

Why is diversification of investment options important for modern platforms?

Diversification allows investors to spread risk across various asset classes, enhancing portfolio performance and reducing volatility. Offering a wide range of investment options also caters to different investor preferences and risk profiles.

What initiatives promote inclusivity and diversity in investment opportunities?

Initiatives such as fractional investing, community investment platforms, and educational programs aimed at underserved communities are promoting inclusivity and diversity in investment opportunities, making investing more accessible to a broader audience.

How do regulatory changes impact market access for investment platforms?

Regulatory changes influence how investment platforms operate by setting guidelines for compliance, investor protection, and market transparency. Balancing regulatory oversight with innovation is crucial for ensuring market integrity and investor trust.